Less Complexity, but works

just like paper-based processes.

Discover Axons Finance’s web-based solution — go paperless, create receipts, and manage payments or debts with ease.

.png)

Introduction & Background

Responsibilities & Deliverables

For over 20 years, the accounting department has used paper to issue temporary receipts. These receipts include various supporting documents such as proof of payment, credit notes, and approval forms. However, we now need to transition from paper-based operations to a digital format while maintaining the same functionality. Additionally, the new system must allow all related companies to access and use it collaboratively.

01

CHALLEANGES & PAINPOINTS

Flexibility and Customisation

Paper documents allow users to freely edit, add, or attach files before submission. In digital form, these actions are more limited.

%20of%20person%20doing%20multi%20paper%20work%20pls%20(no%20background).png)

Do things differently

Each company’s accounting or finance team has different processes for issuing receipts and making payments — such as different document cycles or payment methods.

One person, many roles

In some companies, one person handles multiple roles, so if the process is too complex, it can increase their workload significantly.

%20of%20person%20who%20work%20multi-task%20with%20a%20lot%20of%20hand%20and%20work%20aro.png)

And things we need to keep in mind..

Users perform routine accounting tasks and handle many financial documents (10+ papers/task) for both internal and external transactions on a daily basis.

🔁

⌨️

Most of user prefer using the keyboard over the mouse, so clicks should be kept to a minimum.

Some of design must follow

audit's advice since it about financial.

📝

📞

User contract each other via telephone or LINE, so sometimes the document or information lost in it way.

Research Process

When designing the receipt system, we conducted extensive research to ensure it meets real user needs. This included studying workflows to understand how information is gathered and how processes could be standardized for everyone. We interviewed users, observed their daily tasks, and ran think-aloud sessions that encouraged them to share ideas and insights. These findings shaped a solution that is practical, user-friendly, and adaptable across different workflows.

Concept

ALMOST THE SAME BUT EASIER

Do it in 1 go!

A unified platform that handles receipt creation, payment processing, and approval — all in one place.

Reduce work process

The workload has been reduced by optimising the workflow to suit the operations of any company.

Still customisable, but more organised and trackable.

Users can still customise documents and attach various files as before, but with better organisation. All records are stored in a searchable format, with clear tracking of who created, paid, and approved each transaction.

02

IDEATATION & DESIGN TESTING

Process ideation turned into a powerful solution. A program designed to handle it all

For Create Receipt

Payment for receipt

Status Tracking

View details and approve process

Now, discover the key features that make it shine.

03

KEY FEATURES

After conducting ideation, consulting with the development team, and testing prototypes with users, we gathered their feedback to improve our design. This process led to the creation of core features that truly meet user needs and enhance their overall experience.

Key Features 01

Create receipt with invoice easily

From Paper-based

With paper receipts, users must write everything by hand, stamp them, attach several invoices, and sometimes even calculate payment manually.

To Digital-based

In the digital format, we adapted the screen layout from the original paper receipt. Nearly everything on this screen is now almost fully automated.

THAI VER.

ENG VER.

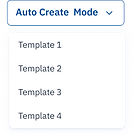

The receipt creation page simplifies repetitive work with smart templates. Instead of re-entering customer details or invoices each time, users can select a template and the system auto-fills everything. This makes the process faster, reduces errors, and creates a smoother experience.

Discover the feature on this page that lets you click less, calculate less, and do more.

The auto-deduction function is designed to simplify balancing debit and credit. Instead of requiring users to manually enter numbers across multiple credit rows, the system always deducts from the top amount to match the total automatically. This reduces repetitive input, minimizes calculation errors, and ensures that the debit and credit sides stay balanced without extra effort from the user.

From debit to credit, the numbers always match-automatically.

Key Features 02

Popover for credit note for payment stage

In the payment process, a document called a credit note is used to match the transferred amount with the total on the receipt, including any attached invoices. A single credit note can be applied to multiple invoices and receipts until its full value is used up. However, using the same credit note across multiple transactions can sometimes lead to confusion. We have simplified this process to make it easier to use and less error-prone.

We designed the credit note as a popover to ensure users can keep viewing the receipt details while making adjustments.

Naturally, the popover (green table) is sized carefully to avoid covering the total amount, allowing users to keep a clear view of the overall figures.

The credit note popover includes a column with clearly presented amounts, helping users easily understand the figures without confusion. The system also performs automatic calculations. (See image below.)

Shows the full unused credit note amount from the start.

Displays the remaining usable credit amount.

This column shows the credit amount to be used in this transaction. The system auto-fills it with the available balance and disabled the input to prevent errors, unlocking only after a credit note is selected.

Credit Note Use-case

Key Features 03

Auto partial

This feature is designed to simplify calculations. The payment condition requires that the amount being paid must match the total amount of the selected receipt (i.e., the combined value of the invoices attached to it) in order to complete the task successfully. The feature is automatically activated when the payment amount is less than the total amount of the receipt. Once the feature is enabled, clicking the action button will instantly adjust the numbers to match the required payment amount.

THANK YOU

%20of%20person%20doing%20multi%20paper%20work%20pls%20(no%20background).png)